UK’s Christmas Crime Trends Reveal the Regions with the Most Increased Risk

09 December 2024

Robert Duke

Christmas is a time of year known for happiness and joy, a time to gather around the fire with your family or wander around the streets admiring the festive lights. However, there are thieves looking to take advantage of empty homes and neatly wrapped gifts.

At Protect Your Bubble, we wanted to find out which areas in the UK have experienced the greatest percentage increases in break-ins over the Christmas period and how this has changed in the last ten years.

We analysed Police recorded crime data to determine how many thefts were made in each area of the UK over the last ten years. This highlights the importance of how having renters' insurance and/or gadget insurance, could provide financial protection against unexpected losses caused by theft or break-ins.

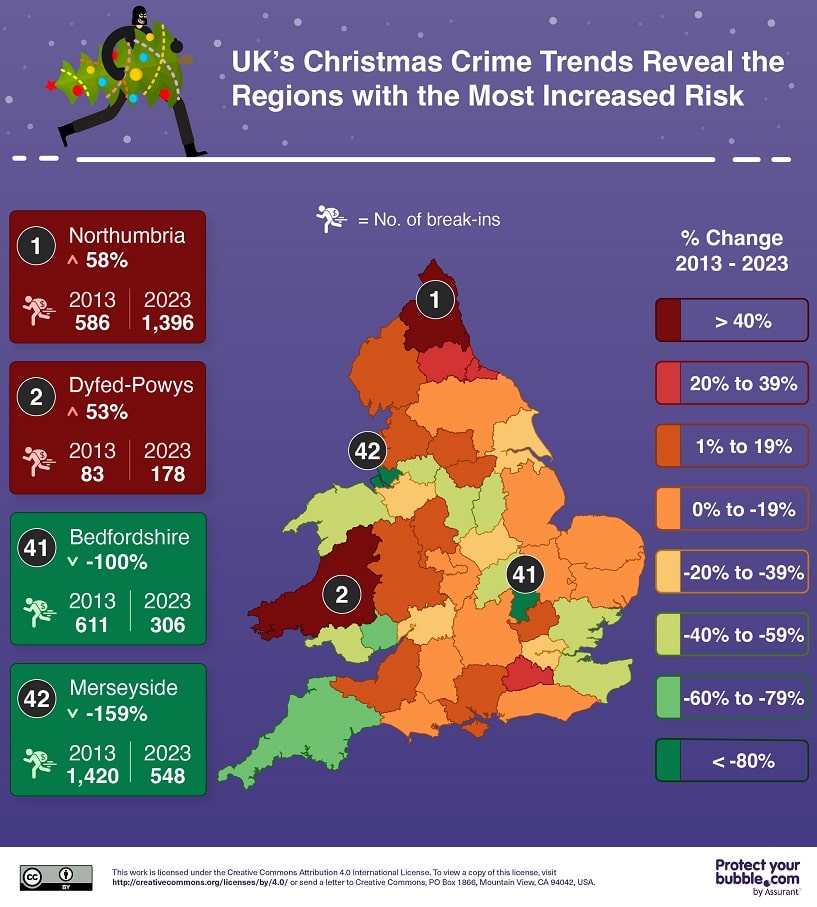

Percentage Change for Break-ins Over Christmas Between 2013 – 2023

The area with the highest increase in burglaries over the last ten years is Northumbria situated in North England, with an increase of 58%, increasing from 586 burglaries in 2013 to 1,396 reported in 2023. The area with the second-highest increase is Dyfed-Powys in Wales, and this area saw a 53% rise between 2013 and 2023, with 83 break-ins reported in 2013 and 178 reported in 2023.

The area which has seen the greatest decrease in break-ins is Merseyside, which covers Liverpool, there was a 61% decrease in break-ins reported between 2013 and 2023 from 1,420 to 548. The second area with the biggest reduction in break-ins is Bedfordshire which saw a 50% decrease, from 611 burglaries reported in 2013 to 306 in 2023.

Renters Insurance can help protect your home in the event of water damage, theft and malicious damage.*

Worst and Best Areas for Break-ins in 2023

In 2023 there were 36k break-ins reported across the UK, 22% of these came from the Metropolitan area with a whopping 8,072 burglaries reported across London over the three-month period. The high figure is likely influenced by the size of the population that reside within the Metropolitan area. The second worst for break-ins is the West Midlands with 2,607 reported, 5.5k fewer than in the capital.

The area with the lowest number of break-ins over the holiday season is Cumbria, which covers the Lake District National Park, with 147 reported over the period. The second safest area for break-ins is Dyfed-Powys. Despite the large increase in burglaries being reported, this area is still one of the lowest in terms of the total number of crimes reported.

Gadget Insurance helps protect your gadgets against accidental damage, mechanical breakdown, theft and loss.**

Worst Years for Break-ins

Over the last ten years, the number of break-ins has fluctuated quite significantly, with the Covid years (2020 – 2022) seeing the lowest numbers, influenced by widespread stay-at-home guidance. Before nationwide lockdown orders, break-ins had become more and more frequent over the holiday period, with 2017 seeing the worst figures at 61k break-ins, this is 27% higher than 2016 which saw 44k burglaries. This is followed by 2018 with 60k and 2019 with 54k break-ins reported, this then dropped significantly in 2020 where just 36k were reported, a 50% drop from 2019.

Conclusion

This data highlights the areas most and least affected by break-ins, emphasising the importance of vigilance, especially in regions with rising rates. From Northumbria's steep 58% increase to Merseyside's remarkable 159% decrease, these figures reveal both challenges and progress.

Stay safe this holiday season by investing in our comprehensive Renters and Gadget Insurance, particularly in areas with higher risks.

Methodology

We analysed Police recorded crime data to determine how many thefts were made in each area of the UK over the last ten years. We recorded the number of ‘Domestic Burglaries’ reported in quarter four of each year for the last ten years in each area.

* T&Cs and £100 excess applies. Single item cover limit £2,000, total cover limit £50,000. Renters Contents Insurance is underwritten by UK General Insurance Limited on behalf of Watford Insurance Company Europe Limited.

** Underwriter Assurant General Insurance Limited. Gadget age restrictions, T&Cs & excesses apply. Customer UK 18+. Accidental Damage and Mechanical Breakdown cover, Theft and Loss available. Covered Worldwide.